when to submit borang e 2018

1 Tarikh akhir pengemukaan borang. Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian.

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Such employee must serve under the same employer for a period of 12 months in a calendar year ie.

. The deadline for filing tax returns in Malaysia has always been. Select E-filing e-Borang e-E The. Starting 1st January 2018 all pupilage files are to be e-filed to the EFS.

Sistem ezHASiL akan memaparkan skrin e-Borang seperti di bawah. Correspondence address State IMPORTANT REMINDER submitted information via 1 Due date to furnish this form. BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut.

If you start in November 2016 youll need to submit Borang E to LHDN by 31st March 2017. Malaysia tp3 tax form in english borang tp3 2015 english version. Setelah berjaya log masuk ke sistem ezHASiL skrin Perkhidmatan akan dipaparkan.

Sistem ezHASiL akan memaparkan skrin eBorang seperti di bawah. Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022. Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau Berkepakaran.

Klik pada pautan e-Borang di bawah menu e-Filing. But if you start in January 2017 youll need to submit Borang E to LHDN by 31st March 2018. A minimum fine of RM200 will be imposed by IRB for failure to prepare and submit the Form E to IRB as well as prepare and deliver Form EA to the employees.

EMPLOYERS RETURN FORM Borang E Submit Employers Return Forms Borang E example E-2018 by 31st March every year even you dont have any employees starting from the following year of LLP registration. Setiap syarikat mesti mengemukakan Borang E menurut peruntukan seksyen 831 Akta Cukai Pendapatan 1967 Akta 53. All companies must file Borang E regardless of whether they have employees or not.

E 2021 Explanatory Notes and EA EC Guide Notes. Employers with their own computerised system and many employees are encouraged to prepare CP8D data in the form of txt as per format stated in Part A. Majikan yang telah menghantar maklumat melalui e-Data Praisi tidak perlu mengisi dan menghantar CP8D.

English Version CP8D CP8D-Pin2021 Format. Borang E English Version InuYasha - Female version by Cyan-Orange-Studio on DeviantArt. In addition every employer shall for each calendar year prepare and render to.

This change is effective from year of assessment 2014 meaning employees under MTD as final tax plan who have been submitting their Form TP1 no longer need to submit their tax returns by the deadline next year ie. Residents and non-residents with non-business income Form BE and M by 30 April. If you start in November 2016 youll need to submit Borang E to LHDN by 31 March 2017.

English Version CP8DCP8D-Pin2020 Format. B Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2019 adalah menjadi satu kesalahan di bawah. Email confirmation from LHDN.

The 2016 assessment year goes according to the calendar year meaning you will be filing your income tax return forms for 1 January 2016 to 31 December 2016. Email confirmation from LHDN. Failure in submitting Borang E will result in the IRB taking legal action against the companys directors.

Borang E 2021 PDF Reference Only. Employers Form E by 31 March 2017. Majikan digalakkan mengemukakan CP8D secara e-Filing sekiranya Borang E dikemukakan melalui e-Filing.

But if you start in January 2017 youll need to submit Borang E to LHDN by 31 March 2018. Gunakan satu 1 CD pemacu USB cakera keras luaran untuk satu 1 nombor E. April 30 for manual submission.

31 March 2019 a Form E will only be considered complete if CP8D is. May 15 for electronic filing ie. Tambahan masa diberikan sehingga 15 Mei 2022 bagi e-Filing Borang BE Borang e-BE Tahun Taksiran 2021.

Tarikh tutup hantar borang cukai e-Filing 2017 LHDN terkini secara online. Failure in submitting the form is an offence and action may be taken under Paragraph 120 1 b Income Tax Act 1967 and upon conviction offenders may be liable to a fine of RM 20000 to RM. Pilih jenis borang pada skrin e-Borang dan klik tahun taksiran yang berkaitan.

Selangor pupils need to submit their borang 1 2 by themselves to Selangor Bar and then the Secretary will spend some 15min to explain all the troublesome procedures to you. Borang b 2018 pdf download. Every employer shall for each year furnish to the Director General a return in the prescribed form Click here to read.

Majikan yang aklumat melalui e-Data Praisi tidak perlu mengemukakan Borang CP8D. All companies Sdn Bhd must submit online for 2018 Form E and. Panduan Pengguna e-Borang ezHASiL versi 32 6 12 e-Borang Pengguna akan dipaparkan skrin Perkhidmatan apabila telah berjaya log masuk sistem ezHASiL.

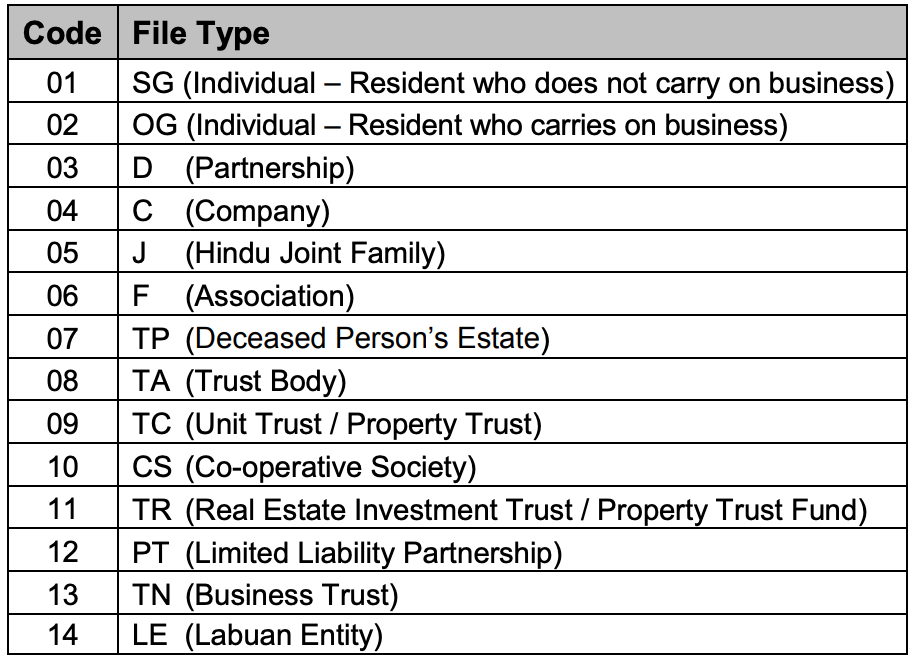

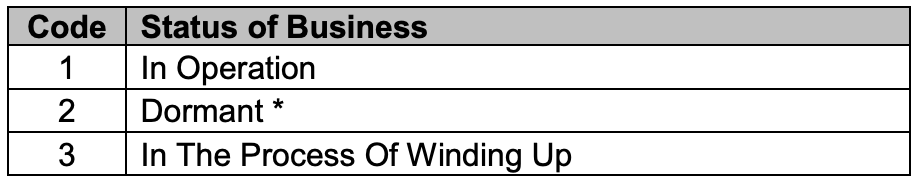

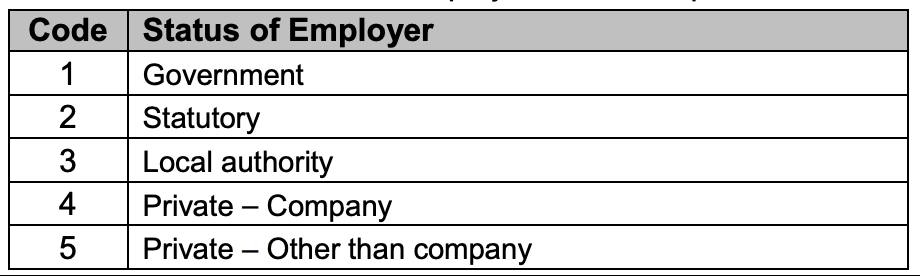

Pada skrin e-Borang pilih jenis borang dan klik tahun taksiran yang berkaitan. 2 UNDER SUBSECTIO COMPLETE THE FOLLOWI Employers no. Every employer shall for each year furnish to the Director General a return in the prescribed form Click here to read.

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News. Cara Isi Borang e-Filing Online. Download Borang E at LHDNs website.

Setiap syarikat mesti mengemukakan Borang E menurut peruntukan seksyen 831 Akta Cukai Pendapatan 1967 Akta 53. Pengemukaan CP8D melalui disket TIDAK dibenarkan. 31 Mac 2019 a Borang E hanya akan dianggap lengkap jika CP8D dikemukakan pada atau sebelum 31 Mac 2019.

Jika pembayar cukai mengemukakan Borang e-BE Tahun Taksiran 2021 pada 16 Mei 2022 BN tersebut akan dianggap sebagai lewat diterima mulai 1 Mei 2022 dan. Klik pautan e-Borang di bawah menu e-Filing. Jan 1 to Dec 31.

The due dates for submission are as follow. Any dormant or non-performing company must also file LHDN E-Filing. All companies Sdn Bhd must submit online for 2018 Form E and.

Download Borang E at LHDNs website. All partnerships and sole proprietorships must now. The LHDNM Inland Revenue Board of Malaysia reminded employers that the due date for submitting Form E Remuneration for the year 2012 is 31 March 2013.

Bagi borang E tarikh tutup penghantaran borang secara online menerusi e-Filling adalah pada 31 Mac 2017. According to LHDN LLP PLT can fill out the Borang E online Login to ezhasilgovmy.

Ea Form 2021 2020 And E Form Cp8d Guide And Download

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Malaysia Tax Guide What Is And How To Submit Borang E Form E

Form E 2018 What You Need To Know Kk Ho Co

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Every Company Needs To Submit Your Form E Borang E Submission

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Malaysia Tax Guide What Is And How To Submit Borang E Form E

Malaysia Tax Guide What Is And How To Submit Borang E Form E

What Is Form E What Is Cp8d What Is E Filling Sql Otosection

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Malaysia Tax Guide What Is And How To Submit Borang E Form E

Malaysia Tax Guide What Is And How To Submit Borang E Form E

Malaysia Tax Guide What Is And How To Submit Borang E Form E

No comments for "when to submit borang e 2018"

Post a Comment